Selecting a home mortgage isn't as basic as it sounds. That's due to the fact that there are numerous kinds of home loans available and they're made up of various componentsfrom the rates of interest to the length of the loan to the lending institution. Let's take a look at the benefits and drawbacks of the alternatives out there, so you can make a notified decision when it pertains to your mortgage.

You can lock the rate, make it adjustable, or do a mix of both. For instance, if you get a 30-year home loan with a 5/1 adjustable-rate home loan, your rate of interest will lock for five years, then adjust yearly for the remaining 25 years. The interest rate remains the same for the whole time it takes you to settle the loan, so the size of your month-to-month payment stays the very same, that makes it much easier to plan your budget.

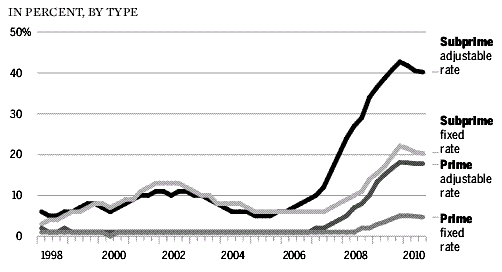

ARMs use a lower rate of interest (and month-to-month payment) for the very first couple of years. Sure, the preliminary low interest rate is appealing, but in exchange for that lower rate in advance, the threat of greater rate of interest down the road is moved from the lender to you - how to rate shop for mortgages. Lots of people find this kind of mortgage appealing due to the fact that they can certify for a more costly home.

ARMs are one of the worst kinds of mortgages out there. Keep more of your money and go with a fixed-rate home mortgage rather. Your mortgage term describes the length of your loan in years. It's a contract with your loan provider on the optimum amount of time it'll take you to settle the loan in complete.

A 15-year term keeps you on track to pay off your house quickly, and normally has a lower interest rate and costs less overall interest compared to longer term loans. A 15-year term comes with a greater monthly payment compared to a 30-year or longer term. You'll have lower month-to-month payments with a 30-year term, compared to a 15-year.

You'll pay dramatically lower monthly payments with a 50-year term, compared to shorter term home mortgages. Your interest rate will be even greater than with a 30-year term, which suggests you'll pay the most in overall interest out of the terms noted here. Choosing a 30-year (or longer) mortgage feeds into the concept that you need to base significant monetary decisions on just how much they'll https://nycold1osv.doodlekit.com/blog/entry/11027463/things-about-what-are-the-interest-rates-on-30-year-mortgages-today cost you per month.

If you wish to get ahead with your cash, you have actually got to take the overall cost into factor to consider. (We'll compare costs of different home loan choices a little later.) A 30-year home mortgage means 15 more years of financial obligation and thousands of dollars more in interest. No thanksgo for the 15-year term, pay less in interest, and.

6 Simple Techniques For Which Of The Following Is Not An Accurate Statement Regarding Fha And Va Mortgages?

A non-traditional loanlike a subprime mortgagebreaks those guidelines. Non-traditional loans also include government-insured programs (FHA, VA, USDA) that set their own underwriting guidelines. If the loan fulfills these agencies' guidelines, they consent to purchase your house if the loan provider forecloses on the house, so the loan provider won't lose cash if you don't pay.

Standard loans aren't backed by the government, so loan providers can charge a greater rates of interest or require a higher deposit (normally at least 5%) compared to non-traditional loans. This kind of loan likewise needs you to pay personal home loan insurance coverage (PMI) if your down payment is less than 20% of the house's worth.

The perceived pro is that loan providers will offer you money to purchase a home, even if you have bad credit and no cash. Subprime home mortgages were created to assist individuals who experience setbackslike divorce, unemployment, and medical emergenciesget a home. Lenders understand there's a huge threat in providing cash to people who have no moneygo figure.

With Federal Housing Administration (FHA) loans, you can get a home mortgage with as little as a 3.5% down payment. You're required to pay a home mortgage insurance premium (MIP)a cost similar to PMI, other than that you have to pay it for the life of the loan. The only method to eliminate MIP is if you have more than a 10% down paymentbut even then, you'll still have to pay it for a duration of 11 years! MIP can add an extra $100 a month per $100,000 borrowed.

No thanks! With Department of Veterans Affairs (VA) loans, military veterans can buy a home with virtually no down payment or mortgage insurance coverage. When you acquire a home with zero money down and things change in the real estate market, you might wind up owing more than the market value of your home.

This cost can vary anywhere from 1.25% to 3.3% of your Extra resources loan, depending on your military status, down payment amount, and whether it's your very first time funding a house with a VA loan. That's anywhere from $2,500 to $6,600 for a $200,000 loan. The United States Department of Farming (USDA) offers a loan program, managed by the Rural Housing Service (RHS), to people who live in backwoods and reveal a financial need based upon a low or modest earnings.

You can't refinance your loan to improve your interest rate, and the prepayment charges are horrendous. USDA subsidized loans are created to get individuals who really aren't ready to buy a home into one. If that's the only way you certify, then you can't pay for a house right now. Prevent the greater charges and covert constraints of non-traditional loans.

Get This Report about Who Took Over Abn Amro Mortgages

Your mortgage will either be thought about a conforming or non-conforming loan, depending upon just how much cash a lender will provide you. A conforming loan is one that meets the standard underwriting guidelines (the approval procedure) of your particular home mortgage program. For example, standards for non-traditional loans are figured out by the FHA or VA, while government-sponsored business like Fannie Mae or Freddie Mac offer the standards for traditional loans.

However they'll only purchase loans that are within the size restricts established by their guidelines. If your loan size surpasses their limitations and doesn't adhere to their guidelinesas is the case with a jumbo loanit's considered a non-conforming loan. With conforming loans, you'll pay a lower rate of interest compared to non-conforming loans.

Jumbo loans go beyond loan amount limits set by Fannie Mae and Freddie Mac, which suggests you can get a higher priced home. They need outstanding credit and larger down payments, and they have greater rates of interest than conforming loans. An adhering Fannie Mae loan will be your most affordable choice here, if you put 20% to prevent PMI.

However there's a kind of home loan that does the opposite. With reverse home mortgages, senior property owners can supplement their minimal income by borrowing against their home equity (the value of your home minus your current loan balance). They'll get tax-free, month-to-month payments or a lump amount from the loan provider. With this type of home loan, you sell off your equitythe part you ownfor money. Presently the limitation in most parts of the nation is $417,000, but in specific designated high-price markets it can be as high as $938,250. Wondering if you're in a high-cost county? Here is the entire list of adhering loan limitations for high-cost counties in specific states. Loans that exceed this amount are called jumbo loans.

Why would you want a jumbo loan? The most convenient response is due to the fact that it allows you to buy a higher-priced house, if you can afford it. However these loans have flexibility that conforming loans don't have, such as not always requiring home mortgage insurance when the down payment is less than 20 percent.

And they often need greater deposits and exceptional credit, which can make them more difficult to receive. You can learn more about these and other programs here. It's likewise a great idea to talk to a local loan provider to hear more about their alternatives get prepared by acquainting yourself with mortgage-related terms utilizing our handy glossary.

If you are considering buying a house, understanding the home loan industry and the numerous kinds of "items" is exceptionally crucial. Because it is most likely you will be paying long-lasting, you are going to want to choose the very best mortgage that meets your budget and needs. Not all mortgages are the exact same and depending upon your scenario, you might require to explore several options.

What Is The Current % Rate For Home Mortgages? Fundamentals Explained

There are lots of subtleties and certifications tied to each of these, and you will require to talk to a home mortgage expert to learn which is ideal for you. This loan is not backed by the federal government. If you have good credit and can put down 3% then you can normally receive this loan backed by Freddie Mac or Fannie Mae.

They sell and purchase nearly all conventional mortgages nationwide. If you wish to prevent needing personal mortgage insurance coverage (PMI) you're going to need to make a minimum of a 20% deposit. However, some loan providers do offer these loans with a lower down payment and no requirement for PMI. This loan is specifically for veterans, service members, and military partners.

This indicates that 100% of the loan quantity can be financed. You also get a cap on closing expenses which is a major benefit. These loans are issued by private mortgage loan providers and are constantly guaranteed by the U.S. Department of Veterans Affairs (VA). Bear in mind that this loan does need a financing fee to help offset taxpayer expenses.

You may also have the ability to pull out of paying funding fees if you are a veteran who did not receive active service pay or any retirement. FHA represents Federal Housing Administration. This loan timeshare advocates is great for first-time home buyers or those who have actually not conserved enough for a big down payment.

Deposits are able this low because of the truth that Federal Real estate Administration loans are government-backed. The benefits of this loan include being able to pay your mortgage at any time without prepayment penalties, lots of term options with fixed rates, and the option for a five-year adjustable rate home loan.

This makes them non-conforming loans. In simpler terms, when a loan quantity reaches a certain point, Jumbo Mortgages and Super Jumbo Loans can use high-end funding that a conventional loan can not. So, if you need to fund a high-end residential or commercial property that is too costly for a traditional loan, this is a great alternative for you.

This mortgage generally provides rates of interest lower than a fixed rate mortgage. Adjustable means that if overall interest rates increase, so will your regular monthly payment. Vice versa, if rates fall, your payment will decrease too. This loan is fantastic if you are having a hard time economically and live in a backwoods (how common are principal only additional payments mortgages).

What Does Hud Have To With Reverse Mortgages? Fundamentals Explained

With this loan, the government can finance one hundred percent of the home expense. This only goes for USDA qualified houses. Advantages consist of no deposit required and much better interest rates. While you might be thinking that one of these loan options sounds like the perfect suitable for your circumstance, depending on the loan type, there are numerous certification requirements you will require to navigate.

In some cases, your personal choice might be another factor that might affect your loan option. After all, you have choices to make on how you want to structure your mortgage and pay it off. From terms and loan length, to deposits and loan size, these elements will affect your options as it connects to your home mortgage.

If you desire to buy a home and you don't have sufficient cash to pay for the whole cost of that home as the deposit, you're probably going to need to get a home mortgage. Easier stated than done, nevertheless. There are a variety of various mortgages you might receive to spend for your home, each with different pros and cons.

One of the most typical differences between home loans is the type of rates of interest they have. Lenders earn a profit by offering borrowers cash and after that asking for it back with interest. The quantity of interest is normally determined by a percentage of the money obtained. For example, if you get a mortgage for $300,000 with a 4% rates of interest, and you pay the minimum payments every month, at the end of the year you'll have paid 12,000.

That involves paying on your premium versus paying on your interest, which you can learn more about here.) With both types of mortgages you have to get house insurance coverage, and it's a good idea to research study house guarantee strategies and get the extra protection on your home. There are two types of interest rates for home mortgages, adjustable and repaired.

Then, the interest rate changes from year to year over the life of the loan. The majority of these loans consist of a cap (it can't exceed 10%, for instance) and doesn't need home mortgage insurance. This kind of home loan is alluring because it reveals a lower rate of interest at the beginning of the loan, which might help people who can't pay as much or are moving quickly.

This kind of mortgage needs home insurance plans and Landmark likewise advises home guarantee plans. A set rate mortgage has a rate of interest that stays the exact same throughout the whole time of the mortgage. These types of home loans can last in between 10 and 40 years. The longer the length of the loan, the smaller the regular monthly payments will be, however the more you'll end up paying on interest.